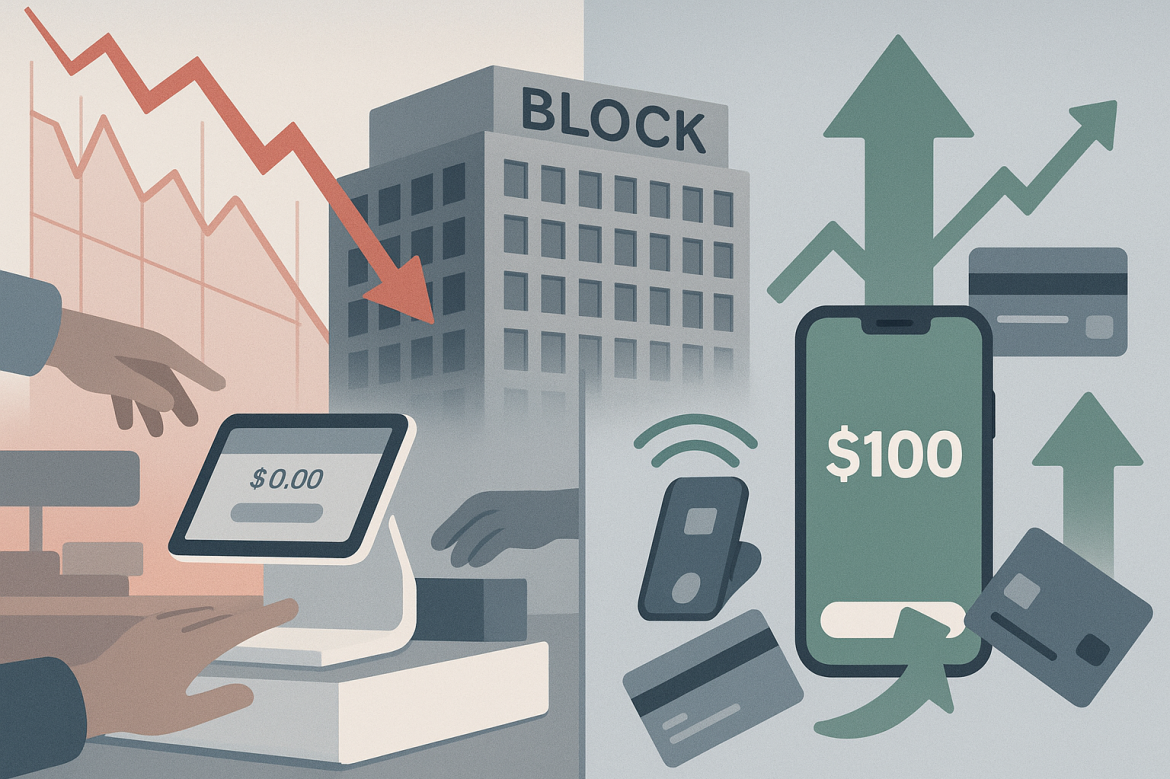

Block Inc. shares fell sharply on Friday after the fintech firm reported third-quarter results that missed Wall Street expectations, highlighting slowing profit growth in its core Square business even as its Cash App segment showed continued strength.

The stock dropped more than 9% following the results, extending its year-to-date losses to 24%.

Earnings miss and revenue slowdown

The company, founded by Jack Dorsey, posted adjusted earnings per share of 54 cents, falling short of the 67 cents expected by analysts polled by LSEG.

Revenue came in at $6.11 billion, below estimates of $6.31 billion, though it marked a modest 2% increase compared with the same quarter a year earlier.

While overall growth was positive, profitability lagged, particularly in Block’s Square business, which serves merchants and small businesses.

Square’s gross payment volume, the total value of transactions processed through its platform, rose 12% year over year, but gross profit grew just 9%, slowing from 11% growth in the prior quarter.

The company attributed the weaker profit performance to a processing partner change and increased low-margin hardware sales, which weighed on overall margins.

“Our product and go-to-market strategies are working as we continued to gain profitable market share in our target verticals like food and beverage, with larger sellers, and outside the US,” said Chief Financial Officer Amrita Ahuja during the earnings call.

Cash App remains the growth engine

In contrast to Square’s moderation, Block’s consumer-facing Cash App unit delivered strong performance.

Gross profit for the segment climbed 24% year over year to $1.62 billion, driven by rising engagement across products like Cash App Borrow, Cash App Card, and the company’s Buy Now, Pay Later offering.

Monthly transacting active users grew to 58 million, underscoring Cash App’s role as a key profit driver within Block’s diversified ecosystem.

Analysts at Morgan Stanley noted they were “encouraged by the pace of credit expansion at Cash App” and are now focusing on whether this growth will translate into higher inflows per active user and greater adoption of direct deposit accounts.

Ahuja described Cash App’s performance as a “bright spot,” reinforcing the company’s goal of leveraging its consumer base to build long-term profitability and expand financial access.

Guidance and outlook

Despite the mixed quarterly results, Block raised its full-year guidance, projecting $10.2 billion in gross profit for 2025 — up from the $10 billion range it forecast in the previous quarter.

For the latest quarter, Block reported total gross profit of $2.66 billion, an 18% increase year over year and slightly ahead of the $2.60 billion expected by FactSet.

The results highlight the dual nature of Block’s financial performance: while Cash App continues to deliver robust growth, Square’s deceleration and margin pressures weigh on investor sentiment.

As the company works to balance its merchant and consumer businesses, analysts will be watching closely to see whether management’s product and market expansion strategies can restore stronger overall growth in the quarters ahead.

At Friday’s close, Block’s shares remained down sharply, reflecting investor caution about the near-term profitability of one of the fintech industry’s most closely watched players.

The post Block shares tumble after earnings miss, slowing Square growth appeared first on Invezz